The Endowment

The University of Chicago’s endowment, 98 percent of which is invested in the Total Return Investment Pool (TRIP), finished fiscal year 2007 with a market value of $6,204.2 million, including $207.0 million of Medical Center endowment. This represented an increase of $1,337.2 million over the June 30, 2006, value of $4,867.0 million. TRIP’s return, net of outside management fees, was 21.0 percent, and was driven by strong capital markets. Every major asset class provided positive returns. Diversification further boosted returns, as alternative asset classes generally outperformed U.S. stocks and bonds. For instance, a benchmark-weighted 85 percent in U.S. stocks (based on the Russell 3000 Index) and 15 percent in U.S. bonds (using the Lehman Brothers Long-Term Treasury Index) would have returned only 17.9 percent. The University’s strong performance can be attributed to high returns in international markets, private equity, real assets, and absolute return.

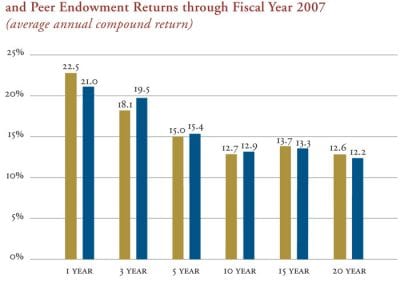

TRIP’s fiscal year 2007 performance compared favorably when measured against the endowment returns of peer institutions (see figure 6). Over longer periods, the University’s mean performance relative to the top twenty endowments has been consistently strong.

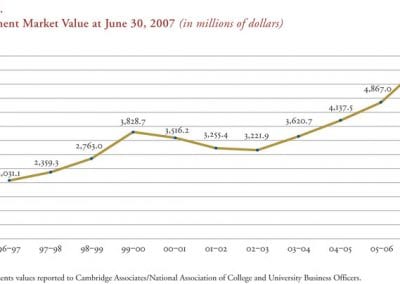

The endowment’s long-term performance is especially important given its dual role of providing support for current operations and for future generations. Between July 1, 1997, and June 30, 2007, with the help of solid investment returns, generous alumni support, and prudent spending, the endowment has increased from $2,031.1 million to $6,204.2 million (see figure 7). During that period, Chicago earned an average annual return of 12.9 percent, while gifts to endowment totaled $639.8 million.

Endowment Management and Asset Allocation

The Investment Committee of the Board of Trustees is responsible for overseeing the investment of endowment funds. The committee’s all-volunteer members, most of whom have significant professional experience managing investments, are Trustees and alumni of the University.

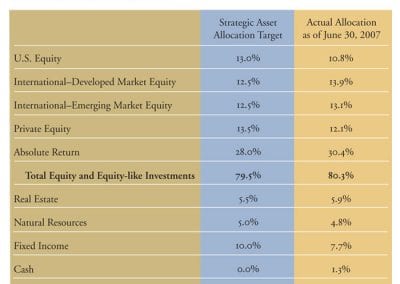

The endowment is well-diversified among a variety of asset classes, with the investment objective of earning equity-like returns with less volatility (see table 1). The strategic asset allocation is reviewed regularly and approved by the Investment Committee. A staff of investment professionals manages the allocations within specific committee-approved ranges. Deviations from the strategic asset allocation are the result of structural factors, such as the difficulty of accessing quality investment opportunities in sectors such as private equity, and active decisions by staff.

In order to meet the return objective, the asset allocation is biased in favor of a broad range of asset classes with equity-like characteristics. To reduce volatility and hedge against adverse equity markets, the endowment also has allocations to high-grade fixed income, real estate, and other real assets.

The Role of the Endowment

The fundamental purpose of the University’s endowed funds is to support the core academic mission of the University by supplying a steady source of income to supplement the operating budget. Currently, the endowment provides approximately 12.6 percent of total revenue. One of the goals in managing the endowment is to increase its contribution to operations. To the extent that University operations can be supported from the endowment, scarce unrestricted funds can be allocated to other University priorities.

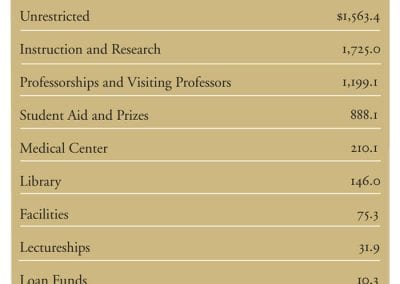

Spending from the endowment is used primarily for academic purposes, going toward academic programs, instruction and research, faculty salary support, student aid, library acquisitions, and maintenance of the buildings and classrooms (see table 2).

Maintaining and growing the value of the endowment over time is critical to ensuring that the steady source of income the endowment provides will not be eroded. At the University of Chicago that is accomplished in a number of ways, including a well-diversified portfolio and a conservative spending policy.

Endowment Spending

The control of endowment spending, a critical factor in maintaining value over time, is a responsibility that is vested in the Trustees of the University. Each year as part of the budget process, the Trustees are asked to approve a level of spending that is within a range of 4.5 percent to 5.5 percent of a twelve-quarter average market value, lagged a year. The flexibility afforded the Trustees by virtue of the range allows them to lower the rate of spending during periods of market appreciation and to increase it during periods of decline. This spending rule, which was implemented with the fiscal year 2005, is fairly conservative in its intent and is designed to strike a healthy balance between long-term asset preservation and prudent spending for current operations. It has the added benefit of cushioning the payout from sudden swings or shocks in the financial markets.

Figure 6. Total Return Investment Pool (TRIP) Return in Fiscal Year 2007 and Peer Endowment Returns through Fiscal Year 2007 (average annual compound return)